Business Entertainment Deduction 2024 Form – Ready or not, the 2024 tax receive those forms in January 2025. During the pandemic, for the calendar years of 2021 and 2022, business owners were temporarily allowed to deduct 100% of the . and attached to your Form 1040. The deduction extends to cover your child under 27 years of age, regardless of dependency status. Broadly speaking, business deductions require you to itemize .

Business Entertainment Deduction 2024 Form

Source : www.thebalancemoney.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

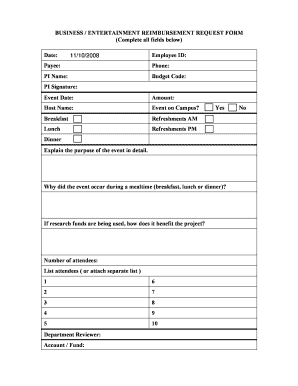

Source : quickbooks.intuit.comBUSINESS / ENTERTAINMENT REIMBURSEMENT REQUEST FORM Physsci Uci

Source : www.uslegalforms.comShannon Williams Accounting Services 228•297•3426 | Saucier MS

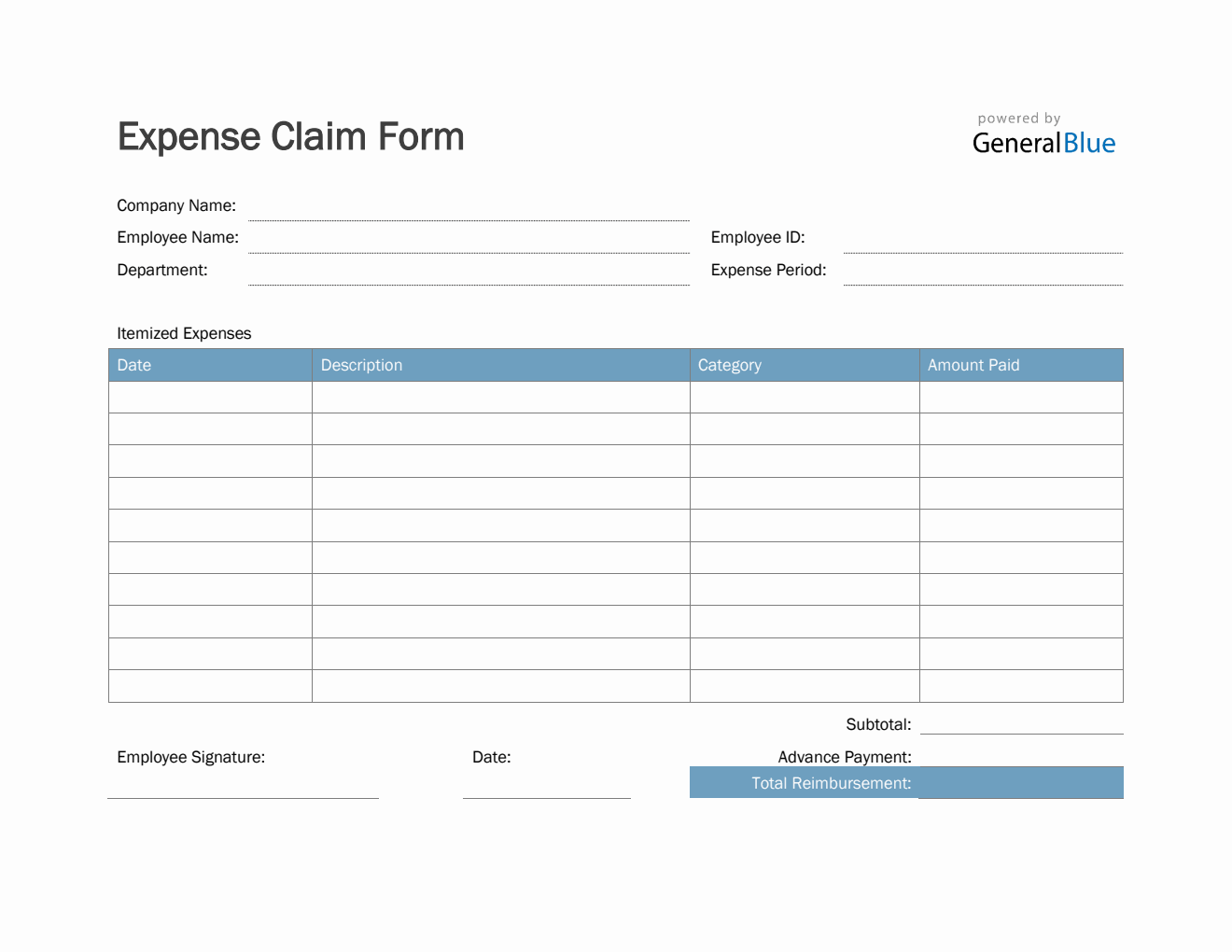

Source : m.facebook.comExpense Claim Form in Excel (Basic)

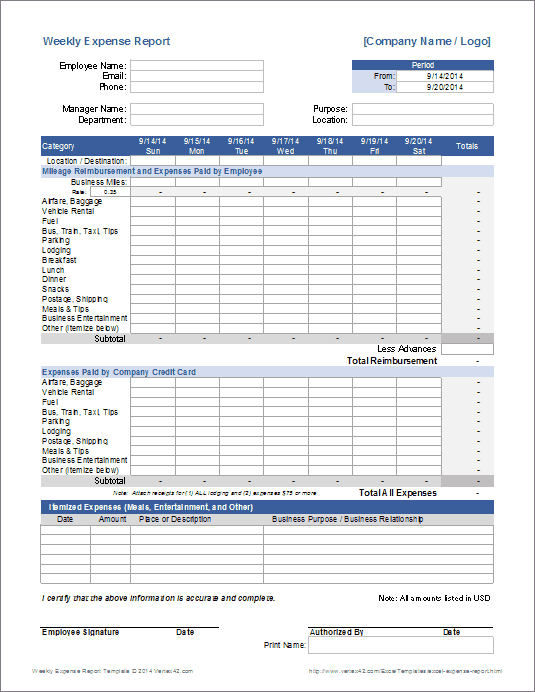

Source : www.generalblue.comWeekly Expense Report for Excel

Source : www.vertex42.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coThe Messenger bets survival on huge ad revenue turnaround

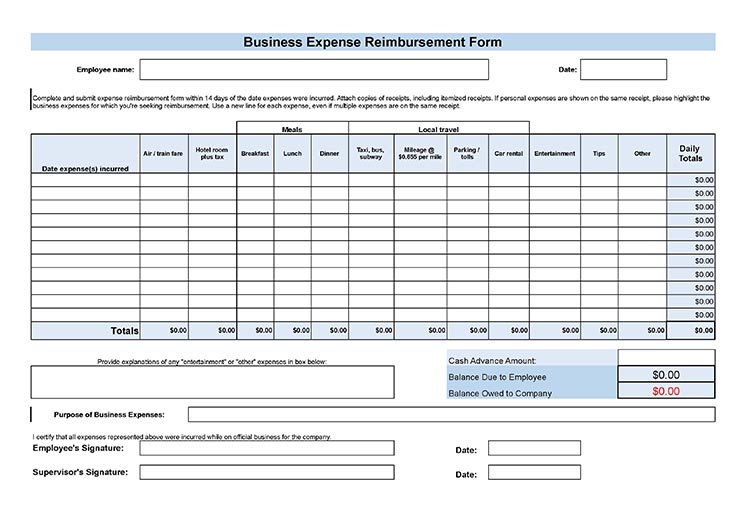

Source : www.cnbc.comFree Employee Expense Report Template (+ Policy)

Source : fitsmallbusiness.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comBusiness Entertainment Deduction 2024 Form Deducting Meals as a Business Expense: If you’re a business owner, don’t overlook some of these easy small business tax deductions that could help improve your bottom line. . January 29 is the official start of the 2024 tax filing season. That means starting Monday through April 15, you can file your 2023 returns. The big change this year is the standard deduction has .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)